Have there been mortgage brokers having solitary mothers?

While you are around aren’t certain solitary mother or father mortgage brokers, there are lots of home loan applications that may meet the needs away from unmarried parents. These loans may help you bypass the problem out-of lower earnings when buying a home as just one parent.

There are even assistance apps that can offer currency with the the downpayment, in addition to homebuyer education apps and something-on-that counseling to help you from the property procedure. In general, purchasing property given that one mother or father could be much easier than do you really believe.

Needless to say, there is no particularly topic since a great typical unmarried parent. Some are rich, although work tough to juggle one another childcare and the personal cash.

When the money’s no problem for you, along with good 20% deposit on family you wish to pick, possible score a normal financial (that perhaps not backed by government entities), considering your credit score was match while don’t have as well much current debt. Your following action is to find a lender you love the latest look of after which get preapproved for the financial.

But life’s nothing like that for most single moms and dads. You could find that money’s tend to tight and that the credit get takes periodic moves. Nonetheless, you, as well, could become a homeowner if you learn ideal financial support system.

Real estate conditions for unmarried moms and dads

The financial may wish to make sure you can also be conveniently manage their month-to-month home loan repayments and the a lot more expenditures that include homeownership. Lenders calculate one to value in the context of your month-to-month funds, having fun with something titled your debt-to-income ratio (DTI).

DTI measures up the month-to-month, pre-taxation money facing the constant expense – together with your coming home loan – to make sure you have sufficient cashflow to help with an effective mortgage payment. In the event the present expense along with your estimated mortgage payment is contained in this 43% of the revenues, just be in a position to be eligible for a home loan.

Due to the fact significantly, you need a fair credit score, which will be any where from 580 to help you 620 or higher founded for the lowest credit history standards towards loan program you like.

Solitary parent home loans

In the event the money’s a tiny firmer on the unmarried money, you may be selecting a mortgage loan who’s loose eligibility conditions. Thankfully, of a lot well-known loan apps try flexible in this regard. Homebuyers can choose from an array of reasonable and you will actually zero-down-commission home loans depending on their needs.

Conforming money (3% down)

Compliant loans is actually a variety of old-fashioned loan one adapts to help you rules applied down by Fannie mae and you will Freddie Mac. You need a down payment away from only step three% of the house purchase price and you may a credit history out-of 620 or finest. But you’ll need to pay personal financial insurance policies (PMI) up until you’ve attained 80% family security

FHA finance (step three.5% down)

Backed by the fresh Federal Houses Management, FHA finance keeps the lowest down payment element 3.5%. And at 580, the financing rating tolerance is gloomier than with conforming finance. Understand $2500 loan that you are able to buy financial insurance costs (MIP) if you do not sell, refinance, otherwise pay the amount borrowed completely. Ergo, many people prefer a compliant mortgage if the the credit history was 620 or even more

USDA funds (zero off)

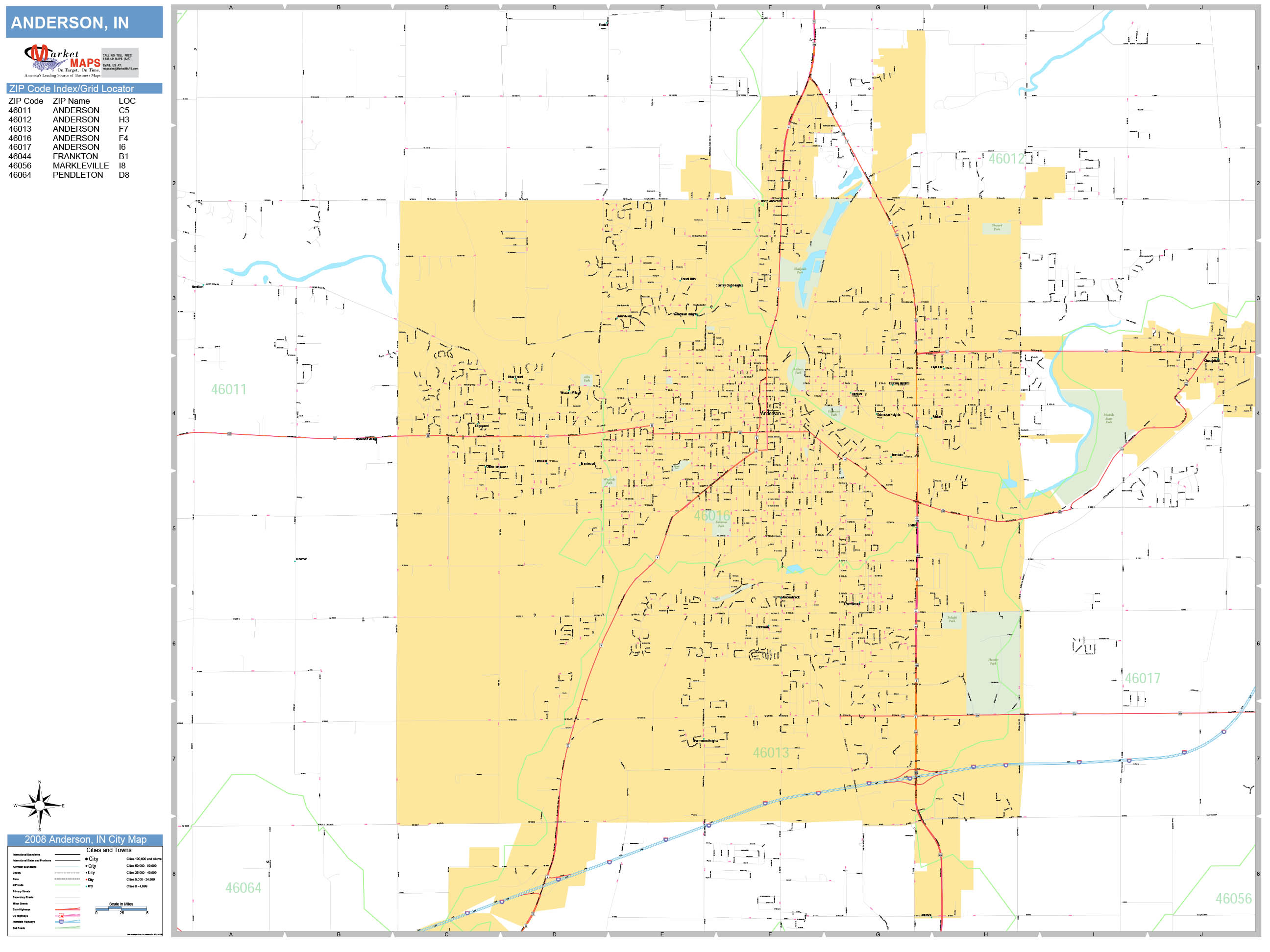

USDA fund is backed by the latest You.S. Department of Farming (USDA). Zero deposit needs. However you need to get into the a selected outlying area (which includes 97% out of America’s landmass) and also have an average or lower than-mediocre earnings into set for which you need it.